|

The Canadian Audit and Accountability Foundation (CAAF) believes government is accountable to its citizens for the way it uses public resources and delivers public goods and services. For accountability to work properly, we believe all parties in the accountability relationship – oversight bodies, public sector departments and organizations, and auditors – play important and interdependent roles. They operate together to form a system of accountability.

In its Proposals that Enhance the Accountability Value of Government Financial Statements, the Public Sector Accounting Board (PSAB) is focusing its efforts to fortify accountability by proposing changes aimed at making financial statements more understandable and transparent.

PSAB has therefore undertaken a project that will affect public sector accounting standards for years to come. They are looking for input before June 30, 2021 on their exposure drafts.

The Canadian Audit and Accountability Foundation is glad to collaborate with PSAB on this important initiative and encourages its members to participate in PSAB’s consultation process. Read the message from PSAB below to learn more.

|

On January 11, 2021, the Public Sector Accounting Board (PSAB) released two significant documents for comment:

Once finalized, these proposals will affect public sector accounting standards for years to come.

The proposals update the foundations on which Canadian public sector entities prepare and present their financial position and results. The proposals were developed through an accountability lens, focused on improving accountability to the public. They aim to respond to the need for understandable financial statements.

Performance auditors and those in an oversight capacity will find the updates helpful. The broad commentary on accountability in the public sector is as relevant to a financial statement preparer or financial statement attest auditor as it is to a performance auditor.

Proposed updates to PSAB’s conceptual framework

To develop a financial statement presentation for governments that is rooted in Canada’s public sector environment and has enhanced accountability value, PSAB researched and identified:

- the key characteristics of public sector entities (inherent public accountability, unique governance structures, multiple public interest objectives, the nature and use of public resources, the volume and financial significance of non-exchange transactions and longevity of the public sector); and

- the objective of financial reporting by public sector entities (accountability to the public and its elected representatives).

Both of these are described in PSAB’s proposed conceptual framework in Exposure Draft, “The Conceptual Framework for Financial Reporting in the Public Sector”, specifically in:

- Chapter 2, Characteristics of Public Sector Entities; and

- Chapter 3, Financial Reporting Objective.

Chapter 3 also states that public accountability requires transparency in the reporting of both financial and non-financial information. The complex nature of the public sector, its myriad objectives and the overriding objective of public accountability require multifaceted reporting. Financial and non-financial aspects of financial reporting are required and must be integrated, if the public is to be fully served by the public sector reports produced.

A visual one-pager of the proposed conceptual framework is available here.

Creating more understandable financial statements

With the public interest in mind, PSAB proposes the following changes to improve understandability and as a result, increase the accountability value of public sector financial statements:

- Relocating the net debt indicator to its own statement, providing the opportunity to better explain it and giving it more prominence than its current location as a subtotal on the statement of financial position.

- Separating liabilities into two categories: financial and non-financial. This would remove the liabilities that were muddying up the net debt indicator from the calculation and return the indicator to its original meaning – future financial resource requirements.

- Restructuring the statement of financial position to have a more familiar look to the public, reporting all assets together and all liabilities together.

- Removing the statement of change in net debt as a required statement, as it’s a reconciliation that’s not very understandable, and some questioned its accountability value.

- Allowing the option to present the change in net debt along with the calculation of net debt if it is determined it provides necessary accountability information and can be made understandable. An explanation of what net debt means is also required. These changes mean the government’s narrative about net debt and why it changed can focus on one statement.

- Requiring the budget amounts reported for comparison purposes in the financial statements to be presented using the same basis of accounting, same accounting principles, for the same scope of activities, and using the same classifications as the actual amounts.

- If the approved budget is not prepared using the same basis of accounting, same accounting principles, for the same scope of activities, and using the same classifications as the financial statements, requiring that the reconciliation of the budget numbers reported on the operating statement with the approved budget, be understandable.

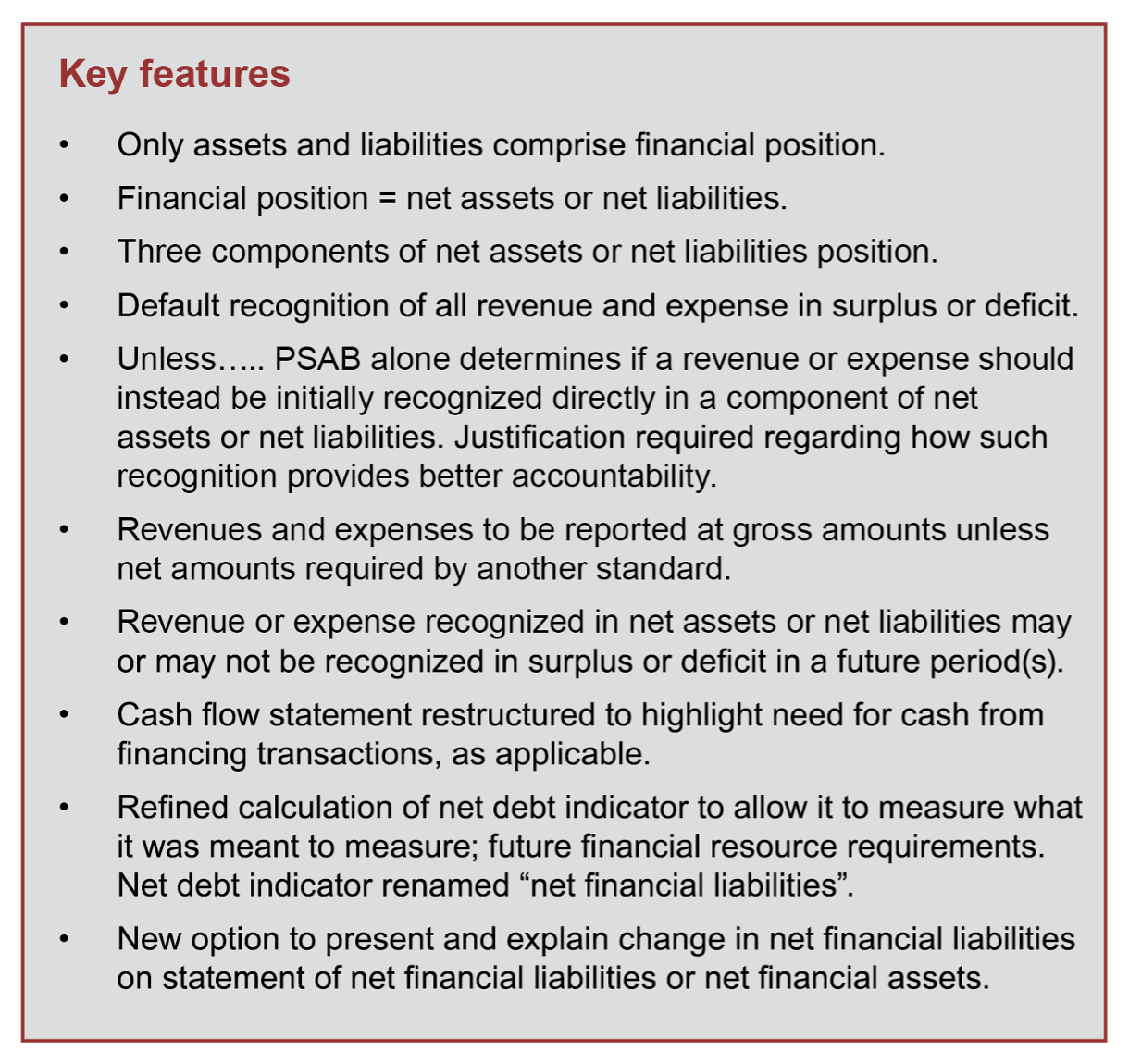

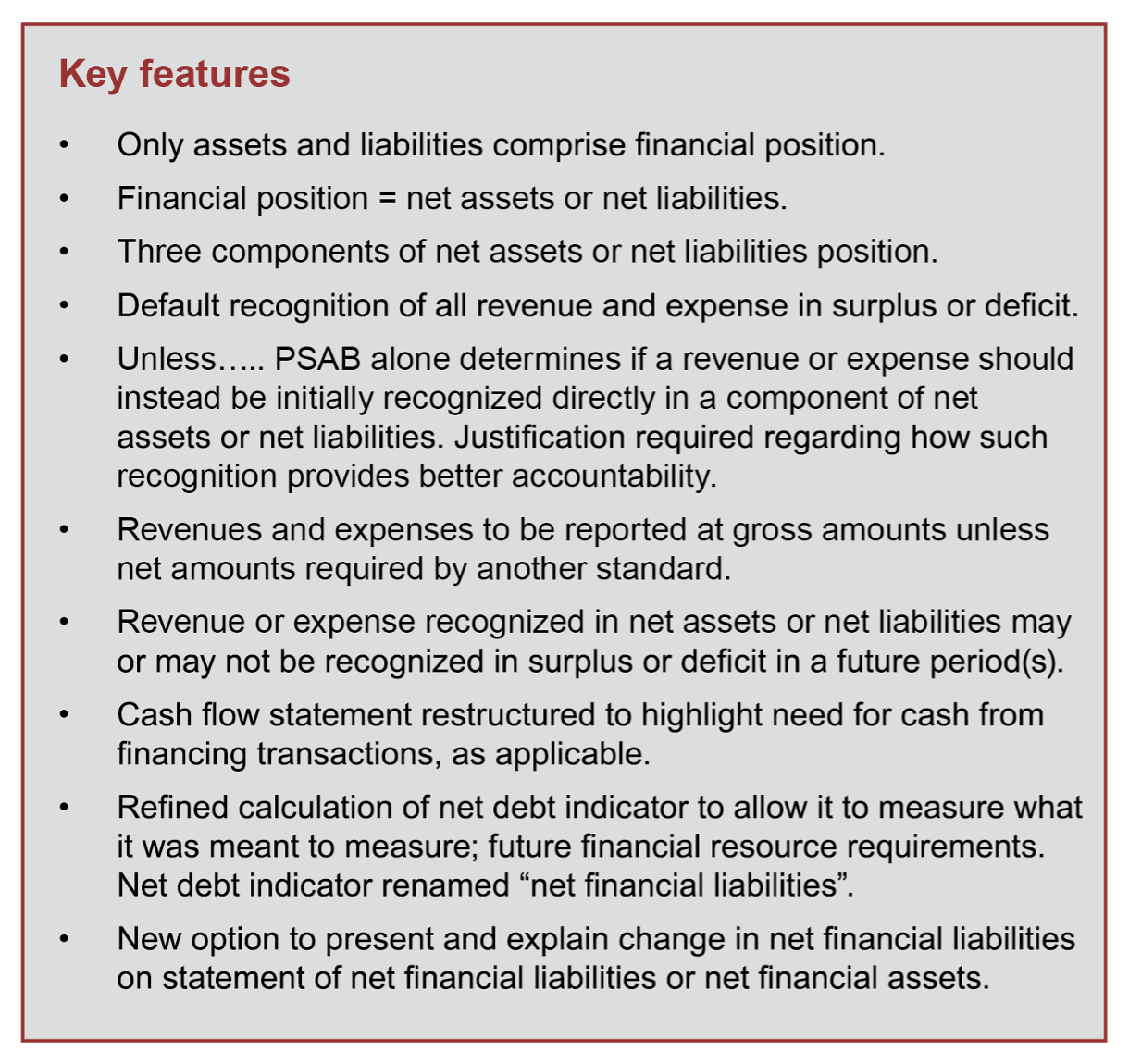

Key features of the proposed changes to the financial statements are summarized in Figure 1. A visual one-pager of the proposed financial statement presentation is available here.

Figure 1- Key features of the proposed changes to the financial statements

SETTING STANDARDS, TOGETHER

Finalizing the reporting model and conceptual framework exposure drafts is a collaborative effort. Public Accounts Committees (PACs), financial statement preparers and Auditors General play a key role in supporting accountability for government spending. As a result, PSAB is asking for your input on the proposals. We want to hear from you by June 30, 2021 to hear what you think of PSAB’s proposals. You can send us your thoughts by:

ADDITIONAL INFORMATION

If you are interested in learning more, please feel free to tune in to the following:

CONTACT

Antonella Risi, CPA, CA

Principal, Public Sector Accounting Board

Tel: (416) 204-3484

Email: arisi@psabcanada.ca

Martha Jones Denning, CPA, CA

Principal, Public Sector Accounting Board

Tel: (416) 204-3288

Email: mjonesdenning@psabcanada.ca