Associated challenges

Although emerging technologies such as AI and blockchain offer substantial benefits, their integration into the auditing field is not without its challenges. These sophisticated tools can transform auditing practices, but they also raise a series of complex questions related to reliability, costs, potential biases, and ethical implications. As auditors strive to navigate this advanced technological environment, they face obstacles that can affect the quality and integrity of their work. By exploring the key challenges associated with the adoption of advanced technologies in auditing, we are able to highlight the practical and ethical implications of these innovations. This enables us to demonstrate how these challenges can be addressed to ensure that the benefits of the technologies are not overshadowed by their drawbacks, and how a balance can be maintained between technological innovation and professional rigor.

The introduction of advanced technologies into auditing presents a number of significant challenges that require careful attention. Data reliability is at the heart of these concerns, as increased reliance on digital data raises critical questions about its quality and integrity, essential for reliable audits. At the same time, the costs and resource management associated with adopting these technologies can be substantial, requiring effective allocation and management of technological and human resources to ensure optimum return on investment. Furthermore, algorithmic biases represent a significant risk: without appropriate monitoring and adjustments, algorithms can perpetuate or introduce biases that compromise the objectivity of audits. Finally, the use of these technologies raises serious ethical issues, particularly with regard to data confidentiality and individual consent, highlighting the need to develop robust ethical frameworks for their deployment with due respect for individual rights and professional standards.

Auditing in the public sector

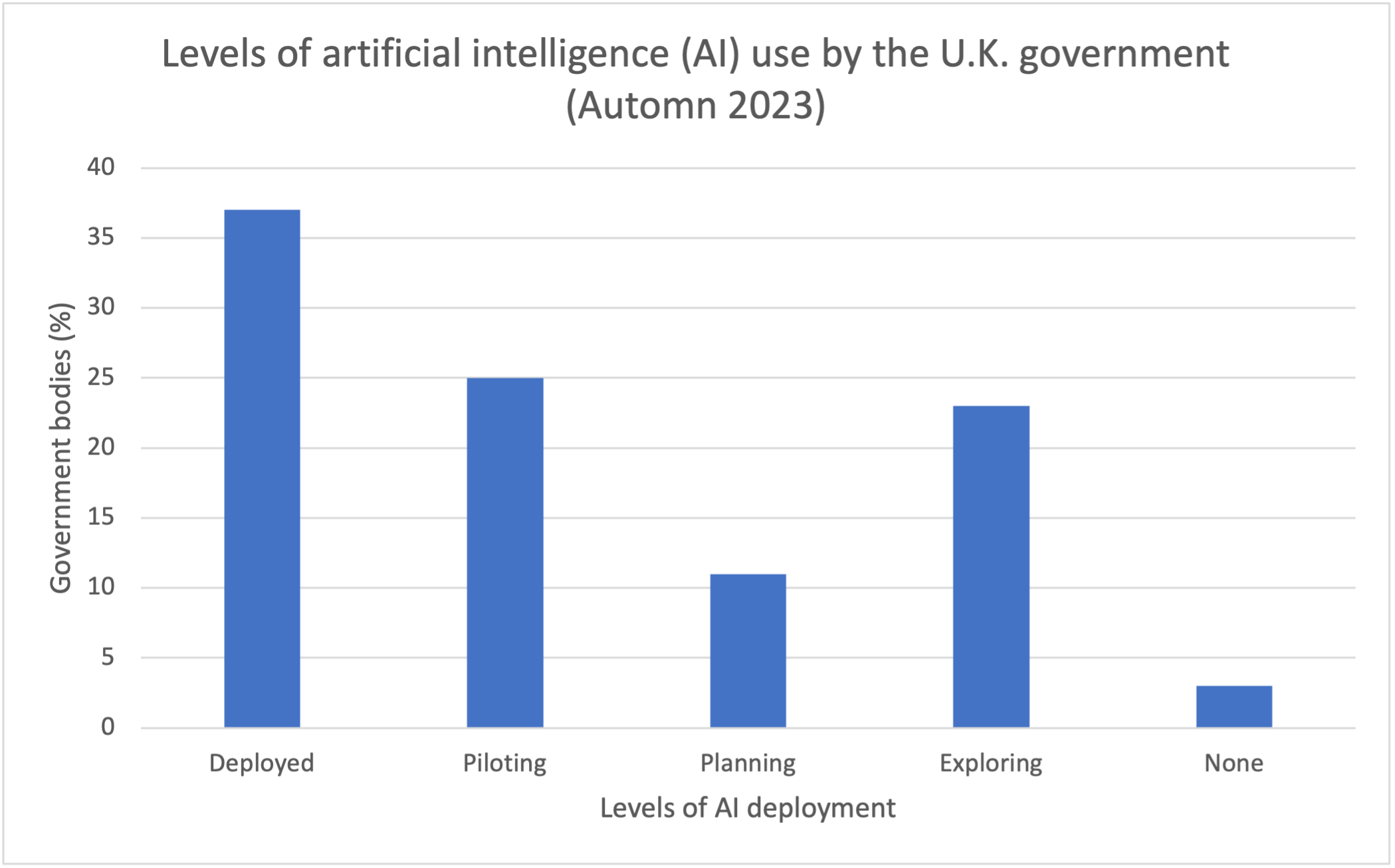

The public sector offers particularly interesting ground for the application of these technologies. Auditing in this sector can benefit significantly from AI for risk management and process improvement. However, AI implementation there is less advanced, although growing. For example, a survey published in March 2024 by the UK's National Audit Office, reveals that just over a third (37%) of organizations responding to the survey were actively using AI, while 37% were piloting (25%) or planning (11%) the use of AI.

Figure 1

Source: National Audit Office. (2024, March 12). Use of artificial intelligence in government.

|

Public sector auditing also faces specific challenges, such as the need for a balance between technology and human judgment, appropriate training for auditors, and maintaining a high degree of transparency and accountability.

Opportunities for public sector auditing

The advent of emerging technologies such as AI and blockchain represents an era of unprecedented transformation and innovation for the auditing profession. These technologies not only address the limitations of traditional methods, but also open up new avenues for rethinking and improving auditing practices. The adoption of these advanced tools offers significant opportunities to improve the accuracy, efficiency and transparency of audit processes, while providing new solutions to the complex challenges of compliance and risk management. We'll be looking at the ways in which emerging technologies can enrich the auditing profession, enabling deeper analysis, earlier detection of irregularities, and greater assurance in an increasingly digitized financial world. We will explore how these innovations can be integrated into public sector auditing practices to not only meet current expectations but also anticipate the future needs of government entities and regulators.

Technological advances in auditing, including public sector auditing, are bringing increased efficiency through automation, which significantly reduces the time needed to complete traditional audits. This efficiency allows auditors to focus on higher value-added tasks, improving the overall quality of audit services. In addition, improved data analysis facilitated by the use of Big Data and advanced analytics technologies enables more accurate detection of risks and anomalies, strengthening auditors' ability to identify potential problems before they become major issues. What's more, integrating blockchain into audit processes improves governance and accountability by making information more transparent and easily verifiable, contributing to greater trust and regulatory compliance, while helping to build and maintain taxpayers' trust in the information they receive from various government entities.