Challenges for public sector auditing

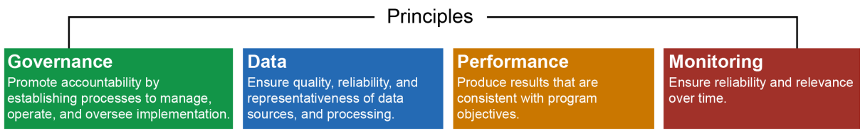

Integrating emerging technologies into public sector auditing presents unique and significant challenges. While these innovations offer opportunities to improve efficiency and transparency, their application in a government context raises specific issues in terms of security, data confidentiality and regulatory compliance. These challenges are exacerbated by the often sensitive nature of the information managed by public entities, and by the need to ensure accessibility and understanding of the audited processes by taxpayers with diverse profiles. In addition, auditors need to be prepared to audit programs that use AI. The Government Accountability Office (GAO) has developed an AI audit framework, represented in Figure 2 below.

Figure 2 – GAO Framework for Audits of AI

Source: Government Accountability Office. (2021, June). Artificial Intelligence: An Accountability Framework for Federal Agencies and Other Entities.

|

The adoption of artificial intelligence, blockchain, and other technologies in government auditing presents certain challenges. Obstacles include training auditors in new technologies, balancing automation and human judgment, and managing citizen and stakeholder expectations. There is reason to question how these challenges can influence public policy, while underlining the need for a cautious and thoughtful approach to integrating these powerful tools into public sector auditing practices.

The increasing integration of technology into public sector auditing requires a significant upskilling of industry professionals, underlining the importance of advanced IT training programs for auditors, which is not unique to the public sector. At the same time, the handling of sensitive data, particularly in governmental contexts, poses substantial ethical challenges, requiring rigorous management in line with established standards to protect the confidentiality and integrity of information. In addition, excessive reliance on technological tools could threaten to undervalue auditors' professional judgment. The latter remains a central pillar of the profession, essential for interpreting audit results and providing qualitative insight that goes beyond simple algorithmic calculations.

Navigating the digital age with care and vision

To navigate effectively in this changing landscape, auditors need to evolve. They need to develop not only their technical skills, but also their understanding of the ethical implications of their work. This includes ongoing training to keep up to date with the latest innovations, and deep reflection on how technology influences the traditional ethical principles of auditing.

The COVID-19 pandemic has accelerated the adoption of many technologies, posing both ethical challenges and organizational questions. Firms and regulators must therefore manage these changes not only in terms of technology, but also in terms of human resources and ethical compliance.

The adoption of emerging technologies such as artificial intelligence is profoundly transforming the auditing profession, offering both unprecedented opportunities and complex challenges. These technologies promise to improve the efficiency, accuracy and transparency of audits, which is crucial in today's fast-moving financial world. However, they also present significant risks, notably in terms of data reliability, costs, resource management, algorithmic biases and ethical considerations.

For auditors and audit organizations, the way forward requires a delicate balance between exploiting the benefits of these technologies and carefully navigating through their practical and ethical implications. It is imperative that the auditing profession does not lose sight of the fundamental principles of ethics and professional rigor while embracing technological innovation.

Ongoing training of auditors will be essential to ensure that they remain not only competent in the use of these technologies, but also aware of the ethical implications of their applications. Organizations will also need to develop regulatory frameworks and guidelines that facilitate the ethical and effective integration of emerging technologies into their practices.

In conclusion, as we move forward into this new digital age, auditors, regulators and policy-makers must work together to ensure that technological innovation in auditing strengthens public trust and improves audit quality. This requires a commitment to investing in skills, developing robust ethical standards, and maintaining an open dialogue on best practices and emerging challenges. By proactively responding to these challenges, the audit profession can not only adapt but thrive, ensuring its relevance and effectiveness in an increasingly digitized future.

Bibliography

Boulianne, E., Fortin, M., &s; Lecompte, A. (2023). Artificial intelligence and data analytics: Ethical implications for accounting. In Research Handbook on accounting and ethics (pp. 168-179). Edward Elgar Publishing.

Boulianne, E., Lecompte, A., &s; Fortin, M. (2023). Technology, Ethics, and the Pandemic: Responses from Key Accounting Actors. Accounting and the Public Interest, 23(1), 177-194.

Desautels, D. (2001). Future challenges: Reflections after 10-years as Auditor General of Canada. International Journal of Government Auditing, 28(1), 1-1,7. https://www.intosai.org/fileadmin/downloads/about_us/IJGA_Issues/former_years/2001/eng_2001_jan.pdf

Government Accountability Office. (2021, June). Artificial Intelligence: An Accountability Framework for Federal Agencies and Other Entities. https://www.gao.gov/assets/gao-21-519sp.pdf

National Audit Office. (2024, March 12). Use of artificial intelligence in government. https://www.nao.org.uk/wp-content/uploads/2024/03/use-of-artificial-intelligence-in-government.pdf

Page 3 of 3

DISCLAIMER: The opinions expressed in this article are those of the author and do not necessarily reflect the views of the Foundation.

See more Voices from the Field