Determining the Degree of Focus on Oversight

When planning a performance (value-for-money) audit that will integrate oversight questions, auditors will need to decide on the focus of the audit. Focus relates to the level or degree of attention given to oversight in a performance audit.

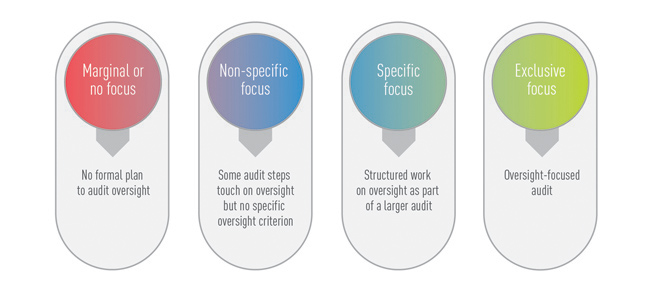

There are many ways in which a performance audit can integrate oversight considerations. Some audits will focus exclusively on oversight while others will only cover oversight as a secondary topic. This varying level of effort and focus directed at oversight can be thought of as a spectrum (see Figure 10) along which are different categories, from “marginal or no focus” to “exclusive focus”:

- Marginal or no focus—There is no formal plan to audit oversight, but the issue comes up during an audit (for example, weak oversight is identified as the root cause of a performance problem).

- Non-specific focus—Some audit steps touch on oversight even though there is no specific oversight criterion.

- Specific focus—Structured audit work on oversight is part of a larger audit. Oversight can be a line of enquiry among others or elements of oversight are looked at under lines of enquiry that primarily focus on other matters.

- Exclusive focus—This is an audit focused exclusively on oversight (a stand-alone audit of oversight).

Figure 10

The Spectrum of Audits of Oversight

Since oversight is a subset of governance, oversight is often audited in the context of governance audits. For example, the Office of the Auditor General of British Columbia has conducted audits of Crown agency board governance (2012) and university board governance (2014) that included examining the oversight responsibilities of selected boards of directors, among other governance aspects. These audits focused exclusively on governance and oversight.

In other instances, oversight is included in an audit as part of a line of enquiry on governance, but governance is only one of several topics being examined. The special examinations of federal Crown corporations conducted by the Office of the Auditor General of Canada follow this model. In these audit engagements, auditors are asked to provide assurance that a corporation’s assets are safeguarded, its resources are managed economically and efficiently, and its operations are carried out effectively. In addition to governance, special examinations include other lines of inquiry on important corporate areas like human resources, financial management, performance measurement, and environmental management. The focus on oversight in special examinations is therefore limited by the requirement to provide assurance on a broad range of significant corporate activities.

Finally, sometimes oversight issues surface in audits where this topic (or governance) was not initially included in the audit scope. In such cases, audit teams will need to modify their scope, seek the necessary internal approvals, and inform the audited organization’s management as appropriate.